Shareholders/Investors

Basic Views

We strive to promote communication with shareholders and investors by fulfilling our accountability for our corporate activities through shareholders' meetings and IR activities. Through these activities, we will maintain and improve the trust of the market and strive to realize appropriate stock prices and increase corporate value through facilitation of proper knowledge about our company. Furthermore, we strive to ensure timely and fair disclosure of information in accordance with policies on constructive dialogue with shareholders.

General Meeting of Shareholders

We consider the general meeting of Shareholders to be a valuable opportunity for communication with shareholders, and we are making efforts to revitalize the General Meeting of Shareholders and facilitate the exercise of voting rights.

- Early dispatch of the Notice of Convocation (at least three weeks prior to the General Meeting of Shareholders)

- Publication of the Notice of Convocation on our website and the Tokyo Stock Exchange website prior to dispatch

- Simultaneous publication of the English version of the Notice of Convocation (excluding the audit report) alongside the Japanese version

- Availability of online voting via the Internet and other methods

- Participation in the Electronic Voting Platform for institutional investors

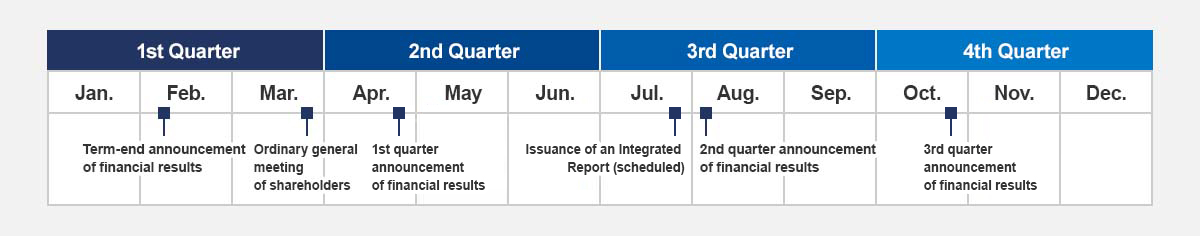

IR Activities

- Financial results briefings (for institutional investors / analysts / mass media)

- Business briefings (for institutional investors / analysts / mass media)

- Company information sessions for private investors (irregular)

- Publication and release of IR tools

- Integrated Reports

- Guide books

- Environmental Activity Reports

Situation of Engaging in Dialogue with Capital Market

| Contact Point for Handling |

The board member in charge of IR is tasked with supervision, and the Corporate Communications Department coordinates with the relevant internal divisions to realize constructive dialogue with investors, including shareholders. To this point, the CEO, the board member in charge of finance, the General Manager of the Corporate Communications Department, the General Manager of the Sustainability Department, and the General manager of the Corporate Legal Department have handled this task. |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dialogue Situation with Investors and Shareholders |

The company semiannually holds account settlement briefings aimed at analysts and institutional investors. The details of questions and answers from these briefings are published on our website. The number of individual meetings with other investors and shareholders is as listed below. |

||||||||||||

|

|||||||||||||

| Main Topics and Items of Interest in Dialogues |

- Business strategies and portfolio strategies - Information disclosure - Management of return on invested capital - Capital policy - Direction of Medium-Term Management Plan to start from FY2024 |

||||||||||||

| Situation of Feedback to Management and Board of Directors Regarding Dialogue Content |

On each occasion of dialogue at an account settlement or business briefing, questions and answers with, and opinions from participants are shared with relevant parties within the company. The opinions and concerns learned through dialogue with investors, including shareholders, is reported as required to the Board of Directors, and feedback is provided to Directors, management, and relevant divisions by, for example, distributing reports concerning the dialogue when necessary. Giving consideration also to the opinions of shareholders and investors, management policies are continuously considered and promoted. As required, we plan disclosures in February 2024 regarding the three major topics below. This is a notification of the state of considerations at the current time, to the greatest extent possible.

- Specific measures aimed at improving performance of management of return on invested capital

In order to establish earnings hurdles regarding investments, including mergers and acquisitions, return on invested capital hurdles will be established and managed for each segment.In addition, we will strive to, as far as possible, make visible how the businesses are closely collaborating to create value, what kinds of fields we will invest in, and so forth. From FY2022, initiatives for improving return on invested capital, which had previously been an issue for the overall company, have been incorporated as an issue for each business unit, and business units have begun to develop ROIC trees and make efforts toward improving each indicator.

- Continuous disclosure of progress regarding points indicated in direction of next Medium-Term Management Plan

The direction of the next Medium-Term Management Plan was disclosed on August 7, 2023. This was based on opinions obtained through dialogues with shareholders and investors.We will continue to seek disclosure that allows shareholders and investors to understand the direction of the company’s business strategy and capital policy, as well as the current status of progress, as accurately as possible.

- Disclosure of capital policy initiatives aimed at improving capital efficiency

Aiming to improve capital efficiency, the company is engaged in considerations regarding how to approach the capital structure and cash allocation in the next Medium-Term Management Plan.Regarding shareholder return, the company has a business policy of a dividend payout ratio of 30% or more, but on the other hand, we are also aware of expectations from our shareholders to pay stable dividends. In that sense, we also believe that adopting not a dividend payout ratio influenced by the profit and loss situation of a single fiscal year, but, for example, dividend on equity and the like as KPIs contributes to improved stability and assists in maintaining and improving capital efficiency. Furthermore, the total return ratio, including agile stock buyback, is an alternative. We plan to announce our capital policy in the next Medium-Term Management Plan, including these shareholder return policy, in February 2024. |

||||||||||||

Inquiry of Investor Relations

Please note that we may not be able to respond to your inquiries depending on their contents such as stock price fluctuations.

Phone

Corporate Communications Dept.

Inquiry via a form

Inquiry about Procedures Related to Shares

Stock Transfer Agency Business Planning Dept., Sumitomo Mitsui Trust Bank

Business hours of the above bank

:9:00-17:00 except on Saturdays, Sundays and public holidays