Addressing Climate Change Risks

Climate change is a very significant issue facing us today. We set "reduction of negative environmental impact" as one of the seven sustainability material issues resolved by the Board of Directors in March 2020, and also identified "climate change" as one of the social issues to be resolved in the "Midterm Corporate Management Strategy 2023", and are promoting initiatives to address these issues.

Response to Recommendations of the Task Force on Climate-related Financial Disclosures

In October 2021, we supported the recommendations of the Task Force on Climate-related Financial Disclosure (TCFD (*1)).

In May 2022, we set a goal to achieve carbon neutrality (i.e., achieve net zero CO2 emissions) throughout the entire SHI Group by 2050 and a reduction target of CO2 emissions by 2030 as determined by the Board of Directors, and we are promoting responses to climate change.

- *1TCFD (Task Force on Climate-related Financial Disclosures)

TCFD is a special private-sector-led organization formed at the request of the G20 and composed of members from a wide range of economic sectors and financial markets around the world, including major corporations and credit rating agencies. It recommends that companies evaluate the financial impact of climate change risks and opportunities on their operations and disclose their governance, strategy, risk management, metrics and targets.

Governance

We have established the Sustainability Committee, reporting directly to the President & CEO, to promote related initiatives under the supervision of the Board of Directors.

- References:

Strategy

The Paris Agreement, which came into effect in November 2016 as a response to global climate change, calls for efforts to keep the global average temperature rise to well below 2℃, and preferably within 1.5℃, as compared to pre-industrial levels. In view of this, our Group has taken action by developing a long-term plan in line with the Paris Agreement.

Risk Assessment for Each Scenario

Climate change may significantly impact the Group’s business activities. Therefore, we have analyzed risks and opportunities based on two assumed scenarios:

- (1) 1.5℃ scenario (measures are implemented and temperature rise is curbed)

- (2)4.0℃ scenario (effective measures are not implemented and temperature continues to rise)

| Definition | ||

|---|---|---|

| High | The impact on business is serious and necessitates a business strategy review. | |

| Medium | The impact on business is limited, but future action is necessary. | |

| Low | The impact on business is minimal. | |

| Period | ||

|---|---|---|

| Short- term | Until 2026 (final year of the MTMP26) | |

| Medium- term | Until 2030 (interim target year for carbon neutrality) | |

| Long- term | Until 2050 (final target year for carbon neutrality) | |

| Scenarios (risks and opportunities) |

Descriptions | Impact Level | Period | |||

|---|---|---|---|---|---|---|

| Short- term | Medium- term | Long- term | ||||

| 1.5℃ | Risks | [Higher electricity and renewable energy prices] Rising electricity and renewable energy prices increase production | High | ● | ● | |

| [Carbon tax] Higher carbon taxes increase the tax burden on subsidiaries and affiliates in Japan and abroad. | Medium | ● | ● | ● | ||

| [Higher development costs and delayed technology development] Delays in technology development lead to increased costs, reduced sales, and lower profits. | High | ● | ● | ● | ||

| Opportunities | [Mechatronics] Electrification of customer production equipment, energy-saving products, and products integrating electronic and control devices with gear reducers, as well as cryogenic and superconducting technologies | Low | ● | ● | ● | |

| [IM] Electrification of customer production equipment, energy-saving products, and power semiconductor equipment | Low | ● | ● | ● | ||

| [L&C] Electrification of construction machinery and logistics systems, and investments in forest resources | Medium | ● | ● | |||

| [E&L] Biomass power generation, energy conversion, energy storage market expansion, and biomass fuel | High | ● | ● | |||

| 4.0℃ | Risks | [Damage to and relocation of manufacturing sites] Costs related to restoring equipment damaged by intensifying natural disasters, and relocating facilities due to rising sea levels, etc. | High | ● | ● | |

| Opportunities | [L&C] Machinery and equipment for disaster recovery | Low | ● | ● | ● | |

| [E&L] Resilient public infrastructure and facilities | Medium | ● | ● | |||

Business opportunities and risks of reducing CO2 emissions through products

| Key investment areas | Foundational business areas | ||

|---|---|---|---|

| Electronic control/robotics and automation | Semiconductor and advanced technology components | Gear business | |

| Strengths | ・ Modular system suggestions leveraging a wide range of products ・ Global sales network |

・ Strong trust from global leaders in semiconductors ・ Advanced high-precision technologies ・ Deep knowledge about customer applications |

・ Wide range of product lineups and high quality ・ Customer base that spreads across industrial fields ・ Global production/sales network |

| External environment /business opportunities |

・ Demand increasing for energy conservation and higher efficiency driven by energy prices and environmental regulations ・ Increased demand for collaborative and service robots and AMRs, as a result of labor shortages and higher labor costs |

・ Demand increases in new areas, including generative AI and power semiconductors, and accompanying changes in demand for each device ・ Energy conservation |

・ Shift in market demand from component sales to system provision ・ Strong demand for maintenance and repair of aging facilities |

・ Applications expanding for servo and highefficiency motors ・ Sales expansion to regions outside Europe |

・ Demand increasing for precision positioning equipment and vacuum robots, driven by acceleration of semiconductor miniaturization and three-dimensional packaging ・ Demand increasing for energy- and heliumsaving measures in medical systems |

・ Demand increasing for package modules and maintenance solutions ・ Drop-in demand increasing, driven by increased end users in emerging markets |

| Risks /issues | ・ Loss of market entry opportunities due to development delays | ・ Loss of opportunities due to delays in taking actions to expand or strengthen global services and S/C ・ S/C risk resulting from US tariff measures ・ Supply constraints due to US-China export restrictions |

・ S/C risk resulting from US tariff measures ・ Declining price competitiveness due to higher material prices |

| Measures to address key issues | ・ Acceleration of collaboration within the Group ・ Expansion of sales areas ・ Sales expansion targeting selected applications |

・ Strengthen development of next-generation models and utilize US assessment and development center ・ Maintain competitive edge by expanding sales of energy-efficient refrigeration systems and accelerated cooling solutions that reduce helium consumption. |

・ Strengthen profitability by consolidating models and revising pricing ・ Strengthen production and supply capacity for each market ・ Strengthen the installed base business |

| Key investment areas | Foundational business areas | ||

|---|---|---|---|

| Semiconductor-related | Advanced medical devices | Plastics machinery | |

| Strengths | ・ Applied technology capabilities that enable us to handle cutting-edge processes ・ Flexible customer support service response ・Customer channels in which ion implantation and laser annealing businesses mutually reinforce |

・ Increased presence through the introduction of a next-generation proton therapy system ・ Expanded scope of application to deep-seated cancers through higher-current BNCT systems |

・ Advanced technology that reduces molding defect rates and save energy ・ Strong organizational capabilities for helping customers solve problems ・ Model lineup that can meet diverse needs |

| External environment /business opportunities |

・ Semiconductor demand is driven by generative AI, but recovery remains slow in other markets, and customer capital spending is postponed. ・ We expect a return to positive growth in the second half of 2025. ・ China remains the largest market, there is a risk of blockage due to tariffs imposed by the US. |

・ Deal planning is thriving mainly in Japan and Asia, but there is a tendency to postpone projects due to soaring costs. ・ BNCT systems continue to command high levels of interest, and standards and guidelines are being established both in Japan and overseas. |

・ Government stimulus measures led to demand recovery in the Chinese market, but demand remains sluggish in other regions. ・ The European market suffers from prolonged slump in demand due to the continued shrinkage of the automotive market, and competition is intensifying with the entry of Asian electric motors. |

| ・ Expansion of applicable models through the development of new materials and processes ・ Increased demand for laser annealing driven by process advancement ・ Process development with global top users |

・ Expansion of applicable disease sites in radiation therapy ・ Further development of medical infrastructure in emerging countries and advancement of medical care in developed countries |

・ Increased demand for products that reduces weight of end products or contributes to achieving carbon neutrality ・ Expansion of market opportunities due to progress in electrification |

|

| Risks /issues | ・ Continuation and acceleration of development investment in technological innovation in semiconductor processes ・ Risk that recovery of the semiconductor market may take longer than expected |

・ Projects postponed or canceled due to soaring construction costs ・Emergence of rival products that use fixed gantries ・ Early expansion of the scope of application (brain tumors, meningiomas, etc.) |

・ Impact of US reciprocal tariff policy on market conditions ・ Intensifying price competition amid sluggish demand ・ Shrinking European market and increasing entry by Asian molding machines |

| Measures to address key issues | ・ Strengthen competitiveness by developing differentiated products ・ Achieve synergy through the integration of the ion implantation and laser annealing businesses ・ Strengthen global expansion through channels owned by LASSE |

・ Implement expansion strategies for proton therapy systems (superconducting type) and BNCT systems (next-generation high-current type) ・ Promote development efforts in the field of radiopharmaceutical therapy (internal treatment, etc.) |

・ Consolidate models and reform business processes ・ Improve profitability by carrying out structural reforms of Demag |

| Key investment areas | Foundational business areas | ||

|---|---|---|---|

| Robotics/automation | Construction machinery (hydraulic excavators and mobile cranes) | Logistics machinery (industrial cranes and logistics systems) | |

| Strengths | ・ Common elemental technologies within the segment can be deployed in other models. ・ Elemental technology development through value chains within the Group |

・ Customers appreciation of attentive service provided through direct service ・ High value-added products and brands differentiated by performance and quality |

・ Advanced engineering capabilities supported by coordination ・ Cutting-edge, advanced remote and automation technologies ・ Provision of attentive, high value-added services |

| External environment /business opportunities |

・ Significant demand for carbon neutrality-related measures ・ Increased demand for productivity improvement, safety, and labor saving |

・ Domestic demand remains resilient. ・ North America demand expected to return as early as second half 2025 |

・ Sustained demand for upgrading industrial cranes ・ Demand for improving logistics efficiency remains solid |

| ・ Government support for use and purchase of electric and ICT construction machinery ・ Advances in AI technology ・Evolution of battery technology |

・ Demand for enhanced safety, cost reduction and shorter work periods in construction work ・ Prolonged labor shortage and aging workers in construction sites ・ Acceleration in carbon neutrality efforts by general contractors |

・ Accelerated carbon neutrality efforts (shift to electric furnaces and renewable energy sources) ・ Diversified needs resulting from declining workforce (automation, working environment improvement, etc.) ・ Efficiency improvement in and logistics transportation (labor and space saving) |

|

| Risks /issues | ・ Functional safety, security measures ・ AI startups’ market entry and collaboration with general contractors ・ High quality, high efficiency development enabled by development and use of common platforms ・ Establishment of in-house differentiating elemental technologies |

・ Intensified price competition (low-priced products’ entry into higher-grade markets) ・ Global political developments affecting S/C |

・ Capital expenditures slowed or postponed due to spike in material and equipment prices ・ Entry by low-price manufacturers from overseas (logistics systems) |

| Measures to address key issues | ・ Establish development center in segment ・ Promote development of common technologies (electrification/remote, automation/DX) |

・ Differentiation and improved profitability through introduction of new models ・ Build optimal production system leveraging Yokosuka Works, etc. |

・ Introduce remote and automation functions in industrial cranes ・ Use DX (SIRMS) to increase added value of services |

| Key investment areas | Foundational business areas | ||

|---|---|---|---|

| Carbon neutrality business | Renewable energy promotion business | Chemical machine, water treatment, food processing machinery, and power boilers | |

| Strengths | ・ Highly efficient technologies specialized in each elemental technology ・ EPC capabilities supported by abundant engineering experience ・ Manufacturing and quality power developed through manufacture of large structures ・ O&M know-how accumulated through many years of maintenance, management and operation services |

||

| External environment /business opportunities |

・ There is a notable trend for stepping up decarbonization policies prompted by climate change risks. ・ Development of technology and infrastructure for CO2 separation, capture and utilization is in progress. |

・ Policies and public-private funding mobilization plans are being promoted for the promotion of the use of renewable energy and the recycling of resources. ・ Associated with this, efforts to consider investment plans are also being stepped up. |

・ There are signs that market conditions will improve for chemicals and water treatment, although the supply-demand balance remains instable. ・ The domestic and international boiler market has slowed, affected by a prolonged inflation in the EU region and soaring biomass fuel prices. |

| Risks /issues | ・ Delays in technology development and formation of collaborative framework. ・Stagnation in efforts to develop a carbon business promotion model ・ Delays in plans to introduce offshore wind power generation |

・ Steadily winning orders amid market slumps ・ Responding to changes in demand associated with changes in regulations and the external environment |

|

| Measures to address key issues | ・ Completion of CO2 separation and capture demonstration ・ Establishing CCU and gasification technologies ・ Carbon-negative technology demonstration ・ Participation in the study of regional collaboration carbon management projects |

・ Starting commercial operation of LAES demonstration facility and promoting efforts to develop business models ・ Strengthening sales capabilities to establish S/C early and develop production a system in preparation for commercialization of foundational structures for offshore wind power generation facilities |

・ Promoting boiler fuel switching modification proposals ・ Strengthening service businesses through coordination between business units within the segment and resource expansion |

Risk Management

Climate change risks are managed through the Group’s risk management process.

- References:

Metrics and Targets

The SHI Group's Board of Directors resolved to achieve carbon neutrality across the entire group by 2050 and set CO2 emissions reduction targets for 2030 to achieve this goal. The SHI Group has designated CO2, a greenhouse gas with particularly high emissions, as a key target for priority measures and set a target for reducing total CO2 emissions. Scopes 1 to 3 are calculated in accordance with the GHG Protocol. Disclosed data is third-party verified by Bureau Veritas.

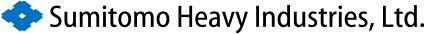

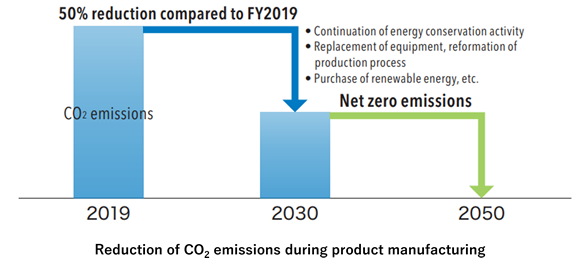

Aiming to achieve carbon neutrality across the entire group by 2050

・Scopes 1 and 2: Reduce CO2 emissions during product manufacturing: 50% reduction by 2030 (compared to fiscal 2019)

・Scope 3 (Category 11): Reduce CO2 emissions during product use: 30% reduction by 2030 (compared to fiscal 2019)

Reduction of CO₂ emissions during product manufacturing (Scope 1 and 2)

In order to reduce CO2 emissions from our business activities, we will continue to implement and strengthen existing energy-saving measures, install solar power generation equipment, and begin procuring renewable energy from fiscal 2022.

In fiscal 2024, CO2 emissions totaled 133,000 t-CO2 (30% reduction compared to FY2019) due to the continued implementation of existing energy-saving measures, the installation of solar power generation facilities, and the purchase of renewable energy power.

| Index | Unit | Base year (2019) |

FY2021 | FY2022 | FY2023 | FY2024 |

|---|---|---|---|---|---|---|

| CO2 emissions during manufacturing (Scope1 and 2) | 千t-CO2 | 189 | 194 | 190 | 157 | 133 |

Initiatives to Reduce CO2 Emissions

In order to reduce CO2 emissions from our business activities, we will continue to implement and strengthen existing energy-saving measures, install solar power generation equipment, and begin procuring renewable energy from fiscal 2022.

In fiscal 2024, CO2 emissions totaled 133,000 t-CO2 (30% reduction compared to FY2019) due to the continued implementation of existing energy-saving measures, the installation of solar power generation facilities, and the purchase of renewable energy power.

The SHI Group plans to increase the proportion of renewable energy procurement to meet its reduction targets.

[Establishment of solar power generation facilities]

We aim to establish solar power generation facilities with a total capacity of up to 40 GWh by 2030 and plan to invest 3.0 billion yen in capital expenditures during the MTMP26 period.

Meanwhile, Yokosuka Innovation Hub, Cs’-Lab+, which was completed in April 2025, is seeking ZEB Ready certification.

[Purchase of renewable energy power]

To meet the reduction targets, we are implementing a global renewable energy power purchase plan. In fiscal 2024, we purchased 85 GWh of such electricity, raising the renewable energy share, including solar power, to 30%.

Reducing CO2 Emissions during Product Use (Scope 3, Category 11)

In fiscal 2024, the CO2 emissions during product use (Scope 3,Category 11) totaled 66 million t-CO2.

Significant reductions continued, primarily due to a decrease in deliveries of coal-fired boilers. However, we expect emissions to rise toward 2030 as our business grows. We will continue developing products that contribute to a decarbonized society.

Cross-Group Initiatives

In January 2025, we launched a carbon neutrality project to accelerate progress toward our self-set targets by raising climate change awareness within each business division.

- ● Project Agenda

- Identifying measures to reduce CO2 emissions (Scope 3, Cat. 11)

- Setting reduction targets for each segment (Scope 3, Cat. 11)

- Investments plans

| Segment | Descriptions | FY2024 |

|---|---|---|

| Mechatronics | Shifting to high-efficiency motors, | 315 |

| Logistics & Construction | Improving the energy efficiency of construction machinery | 29 |

| Total | 344 | |

Climate change response targets in the medium-term environmental plan

The SHI Group recognizes that protecting the global environment and engaging in recycling-oriented economic activities are corporate social responsibilities, and sets targets for the next three years in the medium-term environmental plan it formulates every three years, and is working to reduce its environmental impact. Please refer to the Environmental Management page for details.